The digitalization of accounting is progressing rapidly – and at the heart of it all is the electronic invoice, or e-invoice. What has been optional for many medium-sized businesses until now will soon become a legal requirement: Starting in 2025, companies in Germany will be obligated to receive e-invoices in certain cases – and from 2026, to send them in some instances as well. But what exactly does that mean? What requirements apply? And how can ERP systems like AvERP help businesses respond to the transition in a legally compliant and efficient manner?

What is an e-invoice?

An e-invoice is not simply a PDF file sent via email, as this has been classified as a miscellaneous invoice since the beginning of January 2025. According to the legal definition (§ 14 UStG), an e-invoice is a structured electronic format that is machine-readable – for example, XRechnung or ZUGFeRD. These formats contain all invoicing-relevant data in a standardized XML document that can be processed automatically without manual intervention.

Legal background: This is what comes with the Growth Opportunities Act

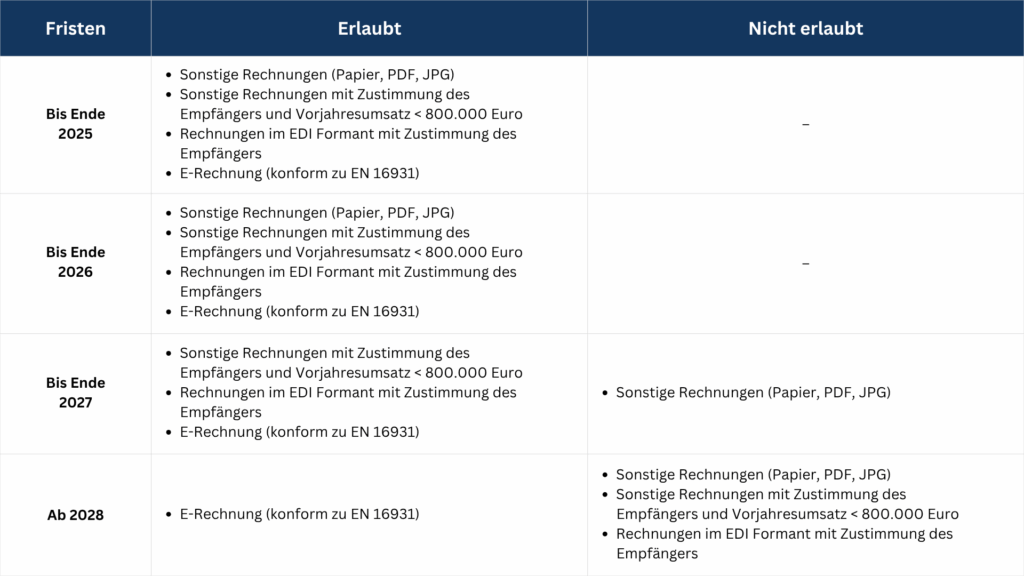

Overview of the transition periods

What does this mean for small and medium-sized enterprises (SMEs)?

- From January 1, 2025: Companies must be able to receive and process e-invoices. (Mandatory for all domestic companies, regardless of size or industry.)

- Until the end of 2026: Paper invoices and e-invoices that do not conform to the new format may still be sent for domestically executed B2B transactions.

- From 2027 onwards: Paper invoices and electronic invoices that do not conform to the new format may still be submitted. However, a maximum annual turnover of €800,000 in the previous year is a prerequisite. If this limit is exceeded, companies are obligated to send the new e-invoices.

- From 2028 onwards: All new requirements and the transmission of data by all domestic companies for services in the area of domestic B2B sales must be complied with.

This means that medium-sized companies, too, must now actively address the switch to electronic invoicing. It’s a challenge that will need to be mastered over a long period.

Many small and medium-sized enterprises (SMEs) still use paper-based invoices or simple PDF templates. Therefore, switching to e-invoicing is not just a technical change, but also a process-related one.

Specifically, SMEs face the following requirements:

- Receiving and processing structured e-invoices (e.g. in XRechnung or ZUGFeRD format)

- Integration of invoice data into the accounting system

- Archiving of electronic invoices in accordance with GoBD

- Ensuring data validity and signature verification (optional)

This requires not only the implementation of new software solutions, but also the training of employees and the adaptation of existing processes.

How ERP systems facilitate the transition

A modern ERP system like AvERP from SYNERPY can significantly simplify the transition to e-invoicing for companies – and simultaneously make accounting more efficient overall. AvERP already supports the import and export of structured invoice formats, enabling the automated creation, sending, receiving, and processing of invoices.

Advantages of AvERP in the area of e-invoicing:

- Integrated e-invoicing functions

- Automated invoice delivery

- Direct interfaces to accounting

- Legally compliant archiving of electronic invoices

- Adaptable to existing processes and workflows

This means that AvERP is not only compliant with the law, but also a real productivity gain for medium-sized companies – from quote creation to payment.

Why act now?

Many companies are waiting to see what happens – but this carries risks. The introduction of e-invoicing affects not only IT, but also financial accounting, sales, and project management. Those who prepare now can not only meet legal requirements in time, but also benefit from the advantages in the long term.

- Less manual work

- Faster payment processes

- Lower error rate

- Transparency and traceability of all booking processes

- Cost savings on postage, paper and archiving

Conclusion: E-invoicing is mandatory – but also an opportunity

The introduction of e-invoicing represents a fundamental change for all companies – but also a great opportunity for digitalization. Those who now opt for a modern ERP system like AvERP not only create the technical prerequisites for mandatory e-invoicing, but also automate key business processes.

As a free, open-source solution developed in Bayreuth, AvERP is particularly attractive for small and medium-sized enterprises (SMEs) that value transparency, efficiency, and flexibility. The transition to e-invoicing thus becomes not an obstacle, but a step towards a more sustainable, digital future.